One Last Puff? - Seritage Growth Properties (NYSE: SRG)

Updated on July 11, 2025.

Seritage Growth Properties (NYSE:SRG) is a publicly traded REIT containing the prime industrial/commercial use properties formerly owned by Sears. Unable to turn the properties into more productive assets, Seritage management is working to unwind its portfolio and pay down its remaining debt to Berkshire Hathaway and other small liabilities. While the company currently trades around $3/share, I believe the liquidation value is around $2.90/share in a best case scenario, and is more likely in the range of $1.25-$2.90/share. I am now bearish on SRG given zero upside in their current share price.

Prior to the bankruptcy of Sears, Eddie Lampert (chief executive of ESL Investments), created Seritage Growth Properties as a REIT to perform a sale-leaseback with Sears in order to raise capital for the declining retailer. Through an equity rights offering of $1.6bn and raising $2.7bn of debt, Seritage began with 235 fully owned properties and 31 joint-venture investments (42.4mn sqft) that were promptly leased back to Sears. Now, Seritage holds just 14 properties.

In 2018, Berkshire lent the REIT $2bn to undergo its transformation. Seritage sold off properties, used short-term leases, and Sears leases to pay down Berkshire. From the latest financial release, Seritage has $240mn outstanding with Berkshire. Additionally, because they needed to quickly pay down Berkshire, redevelopment plans ran into trouble, causing some write downs. With a changing retail atmosphere from consumers preferring in-person shopping to e-commerce, Seritage struggled to deliver its turnaround. Therefore, in October 2022, shareholders approved a “Plan for Sale” and liquidation of the company.

Since its peak during Covid at $23.22/share, SRG stock is down 87%. Aside from management’s failure to recycle prime Sears real estate, a recent significant factor was a revaluation of assets after internal weaknesses in management’s valuations were revealed, which immediately lowered the value of Seritage’s real estate. This scandal with management led to widespread distrust and an exodus from shares. Additionally, optimism for a turn around and a failure to successfully execute this led to investors becoming disinterested in owning shares for the long run.

In the latest quarter, Seritage showed what sales took place and future sales projections. After adding the value of these sales and future sales, applying a tax rate assumption of 25%, and then subtracting Seritage’s remaining debt to Berkshire ($200mn), preferred stock ($71.3mn), and accounts payable ($27.3mn), shareholder’s equity comes out to $163.3mn versus a current market capitalization of $172.4mn. Per share, this equates to $2.90 of value, which leaves current shareholders with about -5% of downside and no upside.

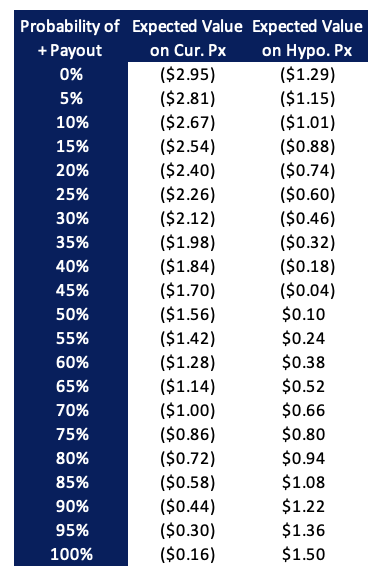

If Seritage is unable to liquidate at stated values, a further downside scenario is 30% to its underlying asset prices. This scenario puts a value on Seritage’s equity of about $5.95mn. At $3.30/share, buyers have -97% of downside. Included in my model is a range of probabilities of a positive payout to equity holders. Under current assumptions, naturally there is a zero percent chance of a positive payout. Assuming a purchase price at slightly less than half SRG’s intrinsic value, there is just a 50% chance for a positive payout, quite literally a coin toss chance.

Since the last update on March 26th, recent developments with Seritage and the realization of an error in my own calculation have caused a shift in opinion on the company. Beginning with my own error, in calculating the intrinsic value of SRG using the latest quarterly press release, I accidentally double counted an asset going through the report and listing assets for sale and already sold. Separately, new concern for Seritage stems from the sale of their Boca Raton asset as reported by The Real Deal. Likely the asset stated in their Q1 2025 press release under premier assets as the “One Asset $60-$70 million,” the Boca Raton asset was sold to Simon Property Group (SPG) for $23 million, an absolute steal for the mall operator. The steep discount to its true intrinsic value likely stems from a private arrangement between the two firms given the former Sears, which closed at the site in 2018, was a connecting neighbor to SPG’s Town Center Mall.

Given the development at the now former Boca Raton site, and the possibility of other similar arrangements at current SRG properties, I now have new concern for how successful SRG management will be at liquidating the remaining properties. Therefore, the final liquidation value will likely be lower than my stated $2.90.